How To Profit From Trading Imbalances

In this article, I will show you how to profit from trading imbalances. It is a strategy that you can use in Forex trading, but it does not only apply to currencies. You can also trade imbalances in Crypto.

First and foremost, go to the Tradingview platform and choose whichever currency pair you want. Then, you can experiment with FAKE money or just on the charts while reading this article. That way you will start gaining experience instantly.

How To Profit From Trading Imbalances Step-By-Step Guide

As with all the articles that I post here on Chrisfxoriginal, I will guide you step by step through the process. So, how do we profit from trading imbalances?

Step1. Identify A Break Of Structure (BOS) On The 4 Hour (4H) Timeframe

First and foremost, we have to identify a BOS on a higher time frame such as on the 4h timeframe. On the image above, the BOS is pointed out with the yellow arrow. Once the BOS occurs, we wait for price to retrace and re-test one of the 4h Orderblocks (OBs).

We will further break down price action and see how we can profit from trading imbalances. Let’s move on to the next step.

Step2. Wait For Price To Retrace And React From a 4H OB (How To Profit From Trading Imbalances)

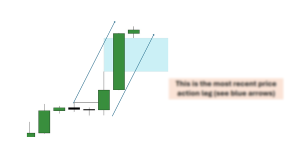

We can clearly see that price is reacting from this 4H OB. Of course, we do not know whether this reaction is going to be the one that will hold. This is why we do not predict, rather we react to what price does. Hence, Once we see the first reaction on the 4H OB, we scale down to the 15min time frame.

This is the exact point in time that we saw a reaction from the 4H time frame. Nonetheless, in order to make things even clearer, we scaled down to the 15min time frame.

We see that price broke many structures after this reaction. Most importantly (even though not necessary), price broke a major structure as we can see from the bottom horizontal line identified with “Bos” on the image above. We move on to the next step.

Step 3. Highlight The Highest 15min Order Block

We now go ahead and highlight the 15min OB that stands at the beginning of the movement that broke structure. It is highlighted with gray color on the image above.

Nonetheless, this strategy is on how to profit from trading imbalances. But wait, read more in order to discover the secret sauce.

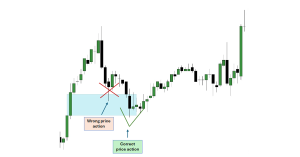

Step 4. Scale Down To The 3 min Time Frame And Identify Imbalances

The gray area is the exact same area of the 15 min OB that we highlighted previously. Nonetheless, now we have scaled down to the 3 min time frame. Now, we will go ahead and identify imbalances within the 15 min OB but on the 3min time frame.

On the image above, I have identified two imbalances from the 3min time frame and within the 15min OB that is still highlighted with the large gray area.

Just pay close attention to the areas of insufficiency between the yellow arrows. Price has not tested these areas and needs to get back and fulfill them at some point. Hence, we highlight those areas and we extend them towards the right. We now expect that price is going to come back and retest them. And this is how we will profit from trading imbalances.

Step 5. Stop Loss And Take Profit Placement At The Imbalance Areas

On the image above, the tiny horizontal lines represent the 2 imbalances that we had highlighted on the 3min time frame beforehand. Nonetheless, now we are on the 4h timeframe and this is the reason why they look so tiny.

How do we place our orders, stop losses and take profits?

We can go ahead and place pending orders (in this occasion sell limit orders) at the beginning of the 3min imbalances, with a stop loss right above them. This is the only way that we can get activated in orders with such small stop losses. Of course, you can also be in front of your chart and initiate a sell with a market execution once price gets there.

The magic now comes down to the fact that we can easily go ahead and target those areas of the 4h time frame that we see, assuming that we will continue with the higher downtrend. If one of these play out, we can target up to 144/1 reward to risk (RR) and 147/1 RR respectively, assuming that we do not close partial profits on the way.

Why Trade Imbalances And Not Order Blocks?

I am sure that if you have made it until this point, you genuinely want to know why do we choose to profit from trading imbalances instead of OBs. The answer is very simple.

We don’t. It is up to us as traders to choose which of the two we want to trade. My advice would be that one should choose what he/she wants to trade, meaning the one or the other!

In other words, if you decide to trade OBs, stick only to OB trading. If you decide to trade imbalances, stick only to imbalance trading.

If you decide to mix up the two of them, then you have to realize that you will be going through periods of huge drawdown. This can be regulated by reducing the risk per trade, but this is totally up to you and I am not here to give any kind of financial advice. I am just sharing my own strategies, my journey, and how I trade.

If you prefer video material, then you can watch my video on this strategy which I embed below:

ChrisFX Courses

Trading strategies (including this strategy on how to profit from trading imbalances) can be very risky if you do not control your emotions and if you do not have a strategy which is giving you a statistical advantage.

It is normal that you will go through periods of consecutive losses and consecutive wins as well. If you want to be able to calculate those aspects of trading in advance and build a robust winning strategy, then you can check out my courses.

In the courses, I teach you elaborate winning trading strategies. Furthermore, I teach you how to build a robust trading plan, starting with the importance of statistics and trading psychology. That way, you can take your trading to the next level.

As with all trading strategies presented here on ChrisFX, if you want to test them out, do so by trading with fake money, or otherwise paper money. NEVER test one of these strategies with real money. When and if you decide to do so, you do so at your own risk and I take zero responsibility for your actions.

Enjoy 🙂