This is The Best Fibonacci Trading Strategy For Great Profits

Read the whole article to learn about the rules of the best Fibonacci trading strategy.

As with all the trading strategies (here is an example) that I show here on ChrisFX, this one also has certain strict rules that we should follow.

First of all, go in the TradingView platform and add the 200 Exponential Moving Average (EMA) in your chart. Change the value to 200 of course (that’s why it’s called a 200 EMA).

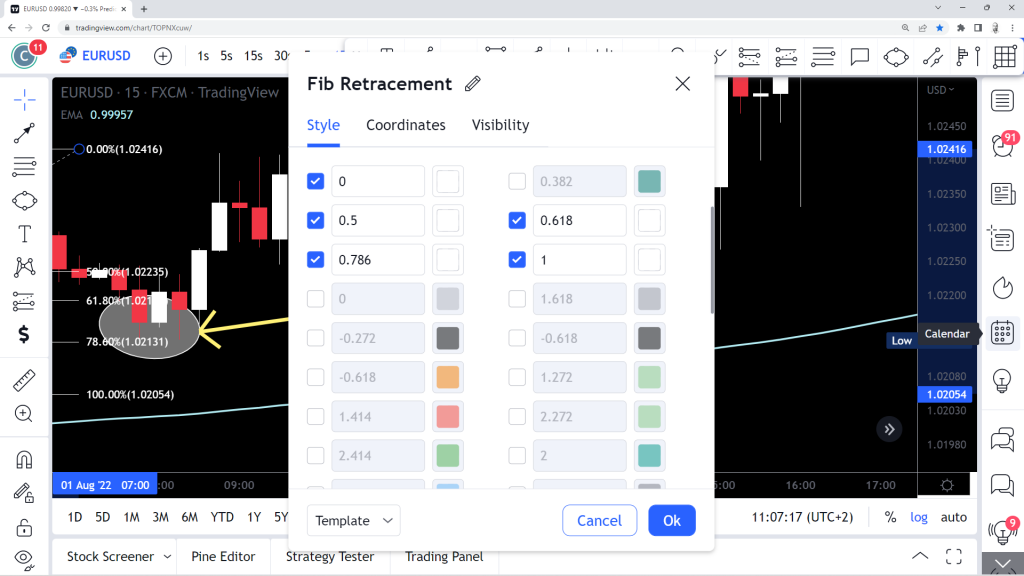

Secondly, let me show you how to add the Fibonacci tool and the values that we will need.

On the image above, you can see where you can find the Fibonacci retracement tool. Just click on the tab saying ”Fib retracement” and you are ready. Now let’s go ahead and insert our values.

On the image above, you can see the settings that I am using for the Fibonacci Retracement tool. As you will see in a bit, for this strategy we will use the 0.78% Fibonacci level. Nonetheless, the 50% and 61.8% Fibonacci levels should always be there in order to put things into perspective.

How does this best Fibonacci strategy work (step by step guide)

I will now guide you step by step on how this best Fibonacci trading strategy works. Furthermore, each step will be accompanied by an image. Hence, you will be able to follow each step easily.

Step 1. Use only the 15 minute timeframe

For this Fibonacci trading strategy, we will use only the 15 minute timeframe. Hence, you do not need to interchange between timeframes in order to find your entries. That being cleared out, when can already move to the next step

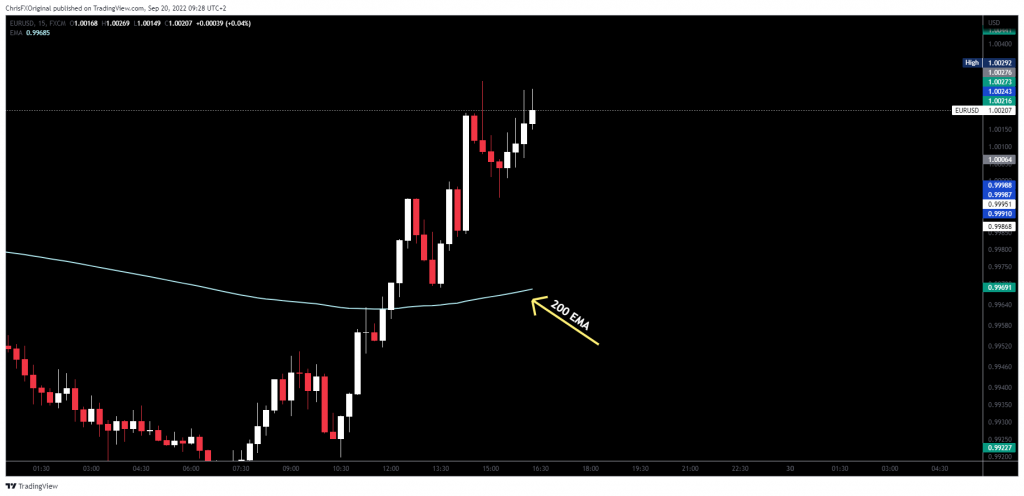

Step 2. The role of the 200 EMA

The light blue line that you see on the image above, is the 200 EMA. In order to add it, go to your TradingView platform and click on the ”Indicators” tab on the top left of your screen.

Once added, double click on it and then go to Inputs –> Length. Change length to 200. There you have it. You are one step closer to learning the best Fibonacci trading strategy out there.

Pay attention. We are interested in buying when price is moving above the 200 EMA, and we are interested in selling when price is moving below the 200 EMA. This is a very important rule to always keep in mind. Let’s proceed to the next step.

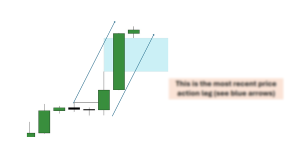

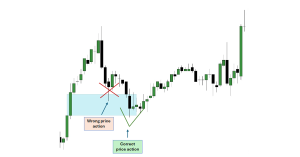

Step 3. Break of structure (BOS) as a crucial step to the best Fibonacci trading strategy

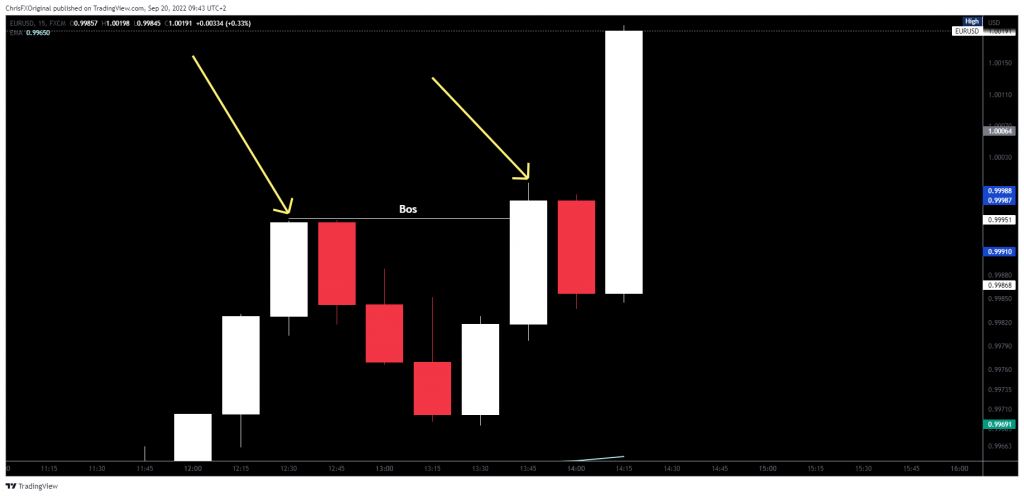

In our example, we are moving above the 200 EMA and hence we are interested for buys only.

Since we are interested only in buying, we want to identify a break of the previous structure’s high. The previous structure is identified by the left yellow arrow on the image above.

The break of structure (Bos) happens with the bullish candlestick that we see by the right yellow arrow. Furthermore, the large bullish candlestick (white candlestick on this chart), shows a clear Bos.

Step 4. The Fibonacci Retracement tool

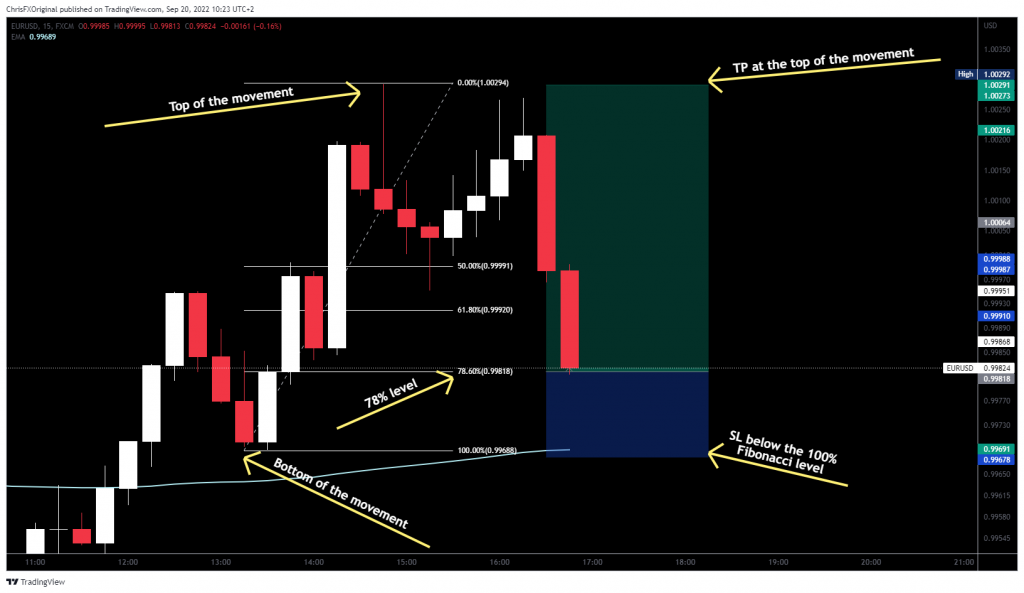

We apply the Fibonacci Retracement tool in the following way. Select the tool, then click on the ”bottom of the movement” and then without clicking drag your mouse to the ”top of the movement”. Then click one more time. There you have it.

Step 5. SL and TP placement

It wouldn’t be the best Fibonacci trading strategy if we would not include a clear rule for SL and TP placement. The rules for that are simple.

You place a buy limit order at the 78.6% Fibonacci level. This means that if and when price retraces back to this level, then your platform will initiate a buy trade. We will place our SL a little bit below the 100% Fibonacci level, while our TP will be at the 0% level.

Here is also my video explaining this strategy step by step:

Important note

If price breaks the 0% level before activating us into the trade, then it is time to re-apply our strategy.

This means that we should then apply the Fibonacci retracement tool again, from the bottom of the new movement, until the end of the new movement.

Day trading strategies (including this best Fibonacci trading strategy) can be very risky if you do not control your emotions and if you do not have a strategy which is giving you a statistical advantage.

It is normal that you will go through periods of consecutive losses and consecutive wins as well. If you want to be able to calculate those aspects of trading in advance and build a robust winning strategy, then you can check out my courses.

In the courses, I teach you elaborate winning trading strategies. Furthermore, I teach you how to build a robust trading plan, starting with the importance of statistics and trading psychology. That way, you can take your trading to the next level.

As with all trading strategies presented here on ChrisFX, if you want to test them out, do so by trading with fake money, or otherwise paper money. NEVER test one of these strategies with real money. When and if you decide to do so, you do so at your own risk and I take zero responsibility for your actions.

Enjoy 🙂